Solar + Battery + Bitcoin Mining

How Bitcoin mining could yield more renewable energy providing more reliable power

Additional authors: Yassine Elmandjra (@yassineARK) & Sam Korus (@skorusARK)

Bitcoin critics often assert that bitcoin mining consumes more resources, specifically energy, than the benefits it creates. What critics deem computationally inefficient and unscalable, however, advocates consider not only an intended tradeoff but a fundamental feature.

Critics also assert that the computation required to secure Bitcoin, even if necessary, is environmentally damaging and ruining the planet.

We believe that the opposite is true: a world with bitcoin is a world that, at equilibrium, generates more electricity from renewable carbon-free sources.

In this piece we hypothesize and illustrate how Bitcoin mining can increase the overall share of renewable energy provisioned to the grid, potentially further skewing both global and Bitcoin mining energy mixes towards renewables.

With real-world data, we seek to demonstrate that bitcoin mining could encourage investment in solar energy systems, enabling renewables to generate a higher percentage of grid power with no change in the cost of electricity. Without bitcoin mining and according to our model, solar — an intermittent energy source — could supply only 40% of grid power before utilities would face the need to fund significant investments with higher electricity prices. With bitcoin mining integrated into a solar system (solar + batteries) however, we believe energy providers — whether utilities or independent entities — could play the arbitrage between electricity prices and bitcoin prices, as well as sell the “surplus” solar and supply almost all grid power demands without lowering profitability.

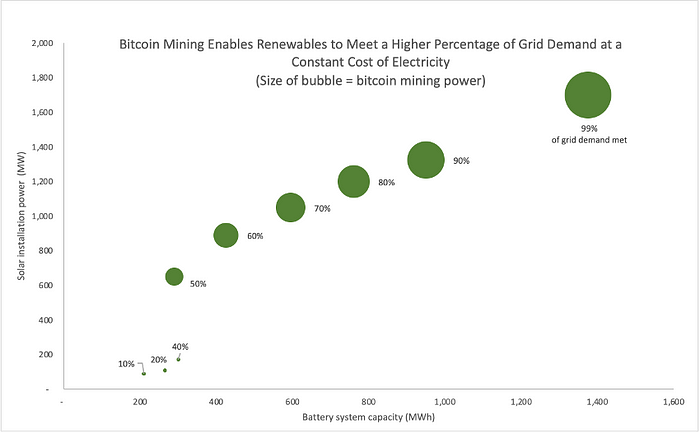

The graph below illustrates the hypothetical impact that bitcoin mining could have on the adoption of solar systems (solar + batteries). Based on a constant cost of electricity, it traces what percentage of power solar could provide to the grid. The y-axis is the power of the solar installation, the x-axis is battery capacity. The size of each circle is proportionate to the size of the bitcoin mining operation. At each point, the solar system provides a different percentage of the grid’s needs. As bitcoin mining scales, the solar system increases in size and provides a higher percentage of the grid’s needs. Increasing bitcoin mining capacity allows the energy provider to “overbuild” solar without wasting energy. In the bottom left of the chart, in the absence of Bitcoin mining, renewables can satisfy only 40% of the grid’s needs. In the top right of the chart, including Bitcoin mining, solar and batteries can satisfy 99% of the grid’s demand.

Our model seeks to demonstrate that integrated bitcoin mining can transfigure intermittent power resources into baseload-capable generation stations. It suggests that the addition of Bitcoin mining into power developers’ toolboxes should increase the overall addressable market for renewable and intermittent power sources. All else equal, with bitcoin mining, we believe renewable energy should be able to provision a large percentage of any locality’s power economically. As a follow-on effect, cost declines associated with scaling renewables could accelerate, leaving them even more economically competitive at equilibrium.

Below:

- We describe the design and implementation of the proof-of-concept model;

- Describe some of the interesting results that it suggests;

- Caution against some of its weaknesses;

- Detail likely directions of future work; and

- Provide access to the underlying excel spreadsheet and offer some instructions on how to use, deploy and improve it.

Design and Implementation of the Proof-of-Concept Model

Our goal in this first model is to provide a proof of concept by minimizing the number of assumptions needed to make such a system work. This goal led us to use historic real-world values wherever possible.

At the most basic level, the model uses a simulated year of sunlight from NREL’s PVWatts tool and pairs it with historic electricity prices and electricity demand for the same location. In this case, Austin, Texas. It also uses historic bitcoin prices, miner revenue, and network hash rates. Miner hardware specifications are a blend of the Antminer S9, S17, and S19.

The logic of the model is such that it is optimized to prioritize meeting grid demand. That is, the energy from the sun will not be used to mine bitcoin unless the demand from the grid is first met. Once grid demand is met, the model assesses whether it is more profitable to store energy in the battery, or to mine bitcoin based on trailing profitability levels. The decision to charge the battery or to mine bitcoin is nuanced and can best be understood by opening the model. Ultimately the state of charge of the battery also plays a role in determining the flow of energy.

Profitability calculations include accommodations for depreciation schedules, operating and maintenance expenses (including accommodations for cooling the mining system) and are compared on a one-year return on capital expense basis. This model is not intended to replace or stand-in for a full net-present-value calculation as would be required for underwriting a full power development project. Instead we sought, as simply as possible, to demonstrate how the additional power-monetization tool that bitcoin mining provides could allow a solar-battery system to provision a higher percentage of any locality’s power at equivalent profit. In this we believe it succeeds.

Additional Results

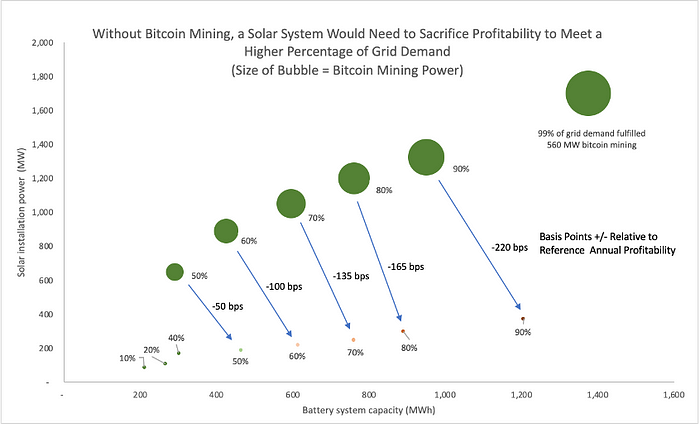

In addition to demonstrating more reliable provision of power at equal profitability — as can be seen in figure 1 — the model can also be used to understand the way in which power systems might be underwritten given the availability of bitcoin mining as a tool for power developers. Below, we extend upon figure 1 to develop two curves. As before, y-axis is the power of the solar installation, the x-axis is the capacity of the battery installation and the size of each point is the size of the bitcoin miner. At each point the system provides a different percentage of the grid’s needs. As the system increases in size the points move up and to the right, and the system provides a higher percentage of the grid’s needs. In the upper curve, system profitability is held constant; the larger bitcoin mining installation allows the system to be effectively over-powered without wasting excess energy. In the lower curve, profitability is optimized without using bitcoin miners at a given target dispatch level. At 90% dispatch there is a >200 basis points in annual return-on-capital difference between a system that can offload power to a bitcoin miner and one that simply relies on solar + battery.

It should also be evident from figure 2 that the bitcoin miner — using the model’s assumptions — provides an alternate and competitive energy storage mechanism to batteries. To meet power reliability needs without a bitcoin miner, a developer would need to build an increasingly large battery. The bitcoin miner allows the developer to more efficiently over-power the system with solar, allowing the miner to soak excess generated energy and power down to accommodate periods of increased demand or patchier sun. In the figure below we show the percentage of the capital expenditure comprised by a 40% dispatch system and by an equivalent profit system which includes bitcoin mining to increase its ability to grid provision up to 90%.

We believe these three-part energy systems should work at all scales and could create interesting opportunities at the residential level, particularly if heat waste from bitcoin mining can be put to use in other applications.

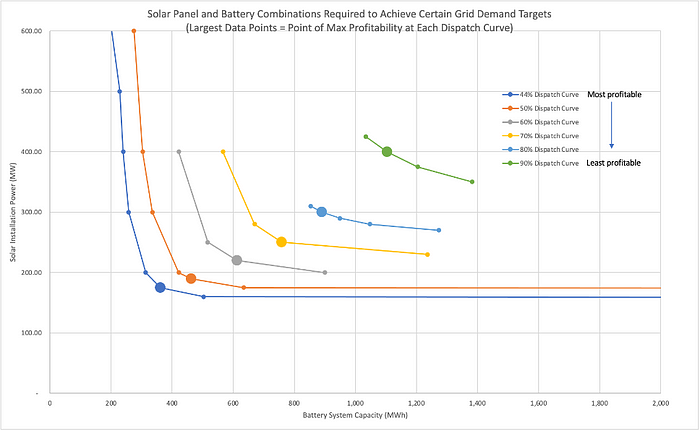

The model can also be used to dimension the trade-off between solar and battery systems exclusive of a bitcoin miner. Each curve below represents different combinations of solar + battery sizes that can be used to achieve a similar level of electricity dispatch. The “elbow” in each curve (the largest datapoint) is the point of maximum profitability for a given level of dispatch, exclusive of an attached bitcoin mining unit.

Ultimately, we hope that this model can serve as a tool to help others understand how the addition of bitcoin mining as an option to solar and other renewable energy developers could allow for more reliable power provisioned at similar return on capital levels. Though this is not captured by this model, the substitutive effects of bitcoin mining for battery systems could also allow renewable provisions to increase even as battery supply remains tight due to demand from electric vehicles. In addition, and perhaps more importantly to power underwriters, we believe a mining-attached solar system would be able to generate revenue as soon as it is internally wired, whereas today’s systems have to wait to sell power until they are interconnected and cleared to sell into the grid — a process which can take months. In addition, a system that relies upon differing and idiosyncratic revenue streams — if properly sized — could provide more reliable and predictable cashflows; this should have the effect of lowering cost of capital for power developers and ultimate result in cheaper renewable energy being offered to the grid.

Some Caveats and Modeling Weaknesses

We believe that though this model is interesting and illustrative, it is by no means complete. The model does not derive a true profitability/cash flow number, but rather a representative one. Ancillary services are not included, nor are tax implications, nor any government credits. The model doesn’t take into account the second order effects of how added solar may impact electricity prices, or how increased mining activity may impact bitcoin’s hash rate and price. Further work could and will be done to demonstrate this result using other time-series extending over multiple years and extracted from other geographies. The model also does not capture battery capacity degradation and energy loss.

Future Anticipated Work

This model could serve as the first of many to come; we hope that others interested in/well versed in these complex systems will contribute along the way. While this serves as proof of concept, future projects could include:

- Providing a sample forward-looking power underwriting model inclusive of a bitcoin mining system.

- Modeling the impact on demand for intermittent energy sources and what that could mean for their respective cost declines.

- Modeling bitcoin mining’s impact on projects waiting to be connected to the grid.

- Modeling the system at an individual home level.

Link to the Underlying Model and Readme File

Please find the link to the underlying model here. We welcome all comments and constructive criticism.

2021, ARK Investment Management LLC. All content is original and has been researched and produced by ARK Investment Management LLC (“ARK”) unless otherwise stated herein.

This material is for informational purposes only and does not constitute, either explicitly or implicitly, any provision of services or products by ARK. Nothing contained herein constitutes investment, legal, tax or other advice and is not to be relied on in making an investment or other decision. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation.

This material is intended only to provide observations and views of the author(s) at the time of writing, both of which are subject to change at any time without prior notice. Certain of the statements contained in this material may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The matters discussed in this presentation may also involve risks and uncertainties described from time to time in ARK’s filings with the U.S. Securities and Exchange Commission. ARK assumes no obligation to update any forward-looking information contained in this material. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain information was obtained from sources that ARK believes to be reliable; however, ARK does not guarantee the accuracy or completeness of any information obtained from any third party.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell, or hold any security. For a list of all purchases and sales made by ARK for client accounts during the past year that could be considered by the SEC as recommendations, please go to https://ark-invest.com/wp-content/trades/ARK_Trades.pdf. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this list. For full disclosures, please go to https://ark-invest.com/terms-of-use.